Owning a home is a smart investment that allows you to build wealth and equity for yourself. It gives you the freedom to live and decorate how you want on your own property, a far cry from the typical rental experience. That said, it can also be financially demanding in a variety of ways, some of which you may not find out about until after you close escrow. In order to maintain your financial stability, you may be searching for ways to reduce your homeownership costs. To figure out how you can reduce your expenses, we must first look at some of the most troublesome areas in your homeowner’s budget.

Some of the largest expenses of homeownership include:

- Mortgage payments (and mortgage insurance): Mortgage payments are based on the cost of the home, your credit score, income, type of home loan you have, and more. According to the latest U.S. Housing Survey, the median mortgage payment is $1,100.

- Property taxes: Property taxes are required for state and local taxes. Property tax is based on the value of your home and is determined by an assessor. These taxes are used to fund programs and services within the city or county you live in. Property taxes can range from several hundred dollars to several thousand.

- Maintenance and Repairs: The need for maintenance and repairs is an inevitable aspect of homeownership. While some may be on the cheaper side (insulating the attic), others can throw a wrench in your monthly budget (pipes bursting). According to Discover, you should plan on setting aside 1% of your home’s value per year to go towards repairs.

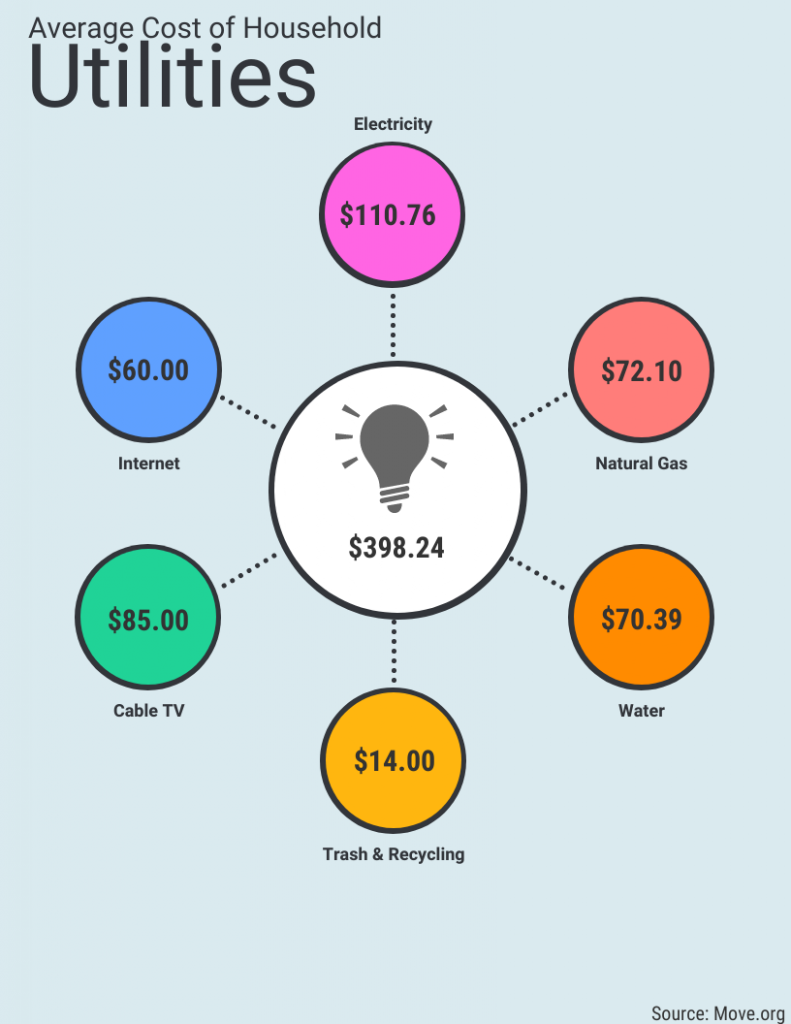

- Utilities: From keeping your house cool during summer to enjoying hot showers after a long day, not to mention having the family stream all day, utilities can add up. Combined, utilities can cost upwards of $300 per month.

- Homeowners association fees: In some communities, HOA fees are required in order to help maintain the operations and aesthetics on behalf of residents. According to Investopedia, these can average around $200 a month, but can be as high as $700 per month.

Whether you are a new homeowner or have had your family home long enough to have raised your children in it, saving money in any way you can, can lessen the burden of homeownership substantially. While it might seem difficult—let’s face it there are many costs of homeownership that aren’t so flexible (HOA fees and repairs)—there are a variety of ways to save money when you own a home, starting with these 3 tips.

#1: Refinance or Pay Off Your Mortgage

Mortgage payments are likely one of the biggest expenses in your monthly budget. Depending on your mortgage terms, you may be able to save money by refinancing. If you are in a better financial position when you refinance (like having a significantly higher credit score), you can qualify for a lower interest rate. Lowering your interest rate can save your substantially over the lifetime of your mortgage.

However, if a lower mortgage payment isn’t sufficient to help with your financial situation, you may also want to consider a reverse mortgage. Reverse mortgages, like those offered by GoodLife, are loans available to senior homeowners who need to supplement their retirement income. If you fall into this category, this type of loan may allow you to pay off your current mortgage, so you can eliminate it from monthly expenses.

#2: Reduce Your Property Tax Bill

While property taxes can vary significantly by state, and even sometimes by county, they are still a notable cost that virtually every homeowner has to pay. According to WalletHub, the average property tax bill in the U.S. is $2,279. For some homeowners, like those who live in states like New Jersey or Connecticut, property taxes are more than double the average.

Whether you live in a state with high property tax rates or considerably lower property taxes, you can benefit by finding ways to save when tax season arrives. There are several ways you can save on your property tax bill:

- Exemptions: Exemptions can apply to a certain group of individuals, such as senior citizens, or a percentage of the property. For example, some states exempt a portion of the home’s value from taxes.

- Deductions: Deductions are a tax benefit that reduces your taxable income, and in turn, lowers your total tax bill. Some common tax deductions homeowners qualify for include mortgage interest and insurance, property taxes paid (on your home, land, or a rental property), and home equity loan interest.

- Credits: Credits are a tax benefit that directly reduces your tax bill. There are a variety of tax credits that may apply to property owners such as energy efficiency credits and local tax credits.

If you’re unsure of whether you qualify for one of these tax savings methods, you may want to speak to a tax professional who can help you make that determination.

To avoid large increases in your tax bill, make sure to do research before making additions or upgrades to your home. For example, adding a pool or expanding the size of your home may increase the value of your home, meaning higher property taxes.

#3: Make Your Home More Sustainable

According to Move.org, the average cost of utilities for U.S. homeowners is $398.24. This includes:

- $110.76 for electricity

- $72.10 for natural gas

- $70.39 for water

- $14 for trash and recycling

- $85 for cable TV

- $60 for internet

If you’re looking for long-term ways to save money as a homeowner, making your household more sustainable may be an effective way to cut down on your bills (now and in the future). From lighting and appliances, to more eco-friendly materials, you can use sustainable alternatives to save money and reduce your household’s carbon footprint at the same time.

While it might be hard to see how this would be an effective way to save money on your home when you’re making a substantial financial investment, the savings you’ll see over time is well worth the trade-off. And, with more and more of these solutions available, the more affordable options there are. If you don’t have the money to invest in making these changes on-hand, there are special types of loans that can be used to make updating your home possible.

Some examples of ways to create an eco-friendly home include:

- Installing solar panels

- Switching to a low-flow toilet and faucets

- Using a smart thermostat

- Upgrading your insulation

- Adding ceiling fans

- Updating lighting fixtures with energy-efficient bulbs

If you’re not sure where to start in your home, determine what utilities are costing you the most and start by taking steps to integrate more energy-efficient solutions in your home.

Start Saving

While it might seem like a lot of effort, even implementing one of these strategies can have a big impact on your budget. Finding ways to cut down on your expenses in these three areas can also help you start a fund for the inevitable repairs and maintenance over the years, college savings, or retirement planning. Whether you are simply trying to live a more frugal lifestyle or have specific savings goals, navigating the expenses that accompany homeownership can help you make the most of your investment.

Author Bio

Alexis Maness has a Bachelor of Science in Integrated Marketing Communications and is a contributing editor for 365businesstips.com. As a professional content writer, she has over five years of experience and is a contributing writer for several San Diego magazines. Alexis specializes in topics related to business, marketing, finance, and hospitality and tourism.

5 thoughts on “How to Save Money When You Own a Home”