Once upon a time in the quaint town of Harmonyville, there lived a newlywed couple named Henry and Emily. They were madly in love and had just embarked on their journey as husband and wife. Henry, a charming and adventurous fellow, had a surprise in store for Emily that would change their lives forever.

The Beginning

One sunny morning, with a sparkle in his eye and a grin on his face, Henry approached his lovely bride. “Em, darling, I’ve got something special to show you,” he said, gently covering her eyes with his hands. Emily giggled in delight as she couldn’t resist his infectious enthusiasm. “Close your eyes and trust me,” he continued.

They hopped into their car, Emily still blindfolded, as Henry drove to a part of town she’d never been before. The anticipation was driving her wild, and she couldn’t wait to see what her beloved husband had in store. The car came to a halt, and with bated breath, Henry finally let her open her eyes.

When Emily beheld the sight before her, her jaw dropped, and her eyes grew wide as saucers. They were standing in front of what could only be described as a house that time had forgotten. The paint was peeling, the roof sagged, and weeds had taken over the once-pristine garden.

“Ta-da!” Henry declared proudly, his enthusiasm unwavering.

“Is this… our new home?” Emily asked in a voice filled with disbelief.

Henry nodded, his excitement still uncontained. “I bought it as a surprise, Em! It’s our blank canvas, and together, we’re going to turn it into the most amazing home.”

Emily didn’t know whether to laugh or cry. “Henry, this is a dump! A literal dump!”

“I know, I know,” he chuckled. “But trust me, it has great potential.”

The house seemed to groan in protest, as if in agreement with Emily’s assessment. Yet, Emily, ever the supportive wife, couldn’t help but smile. “Alright, let’s do this.”

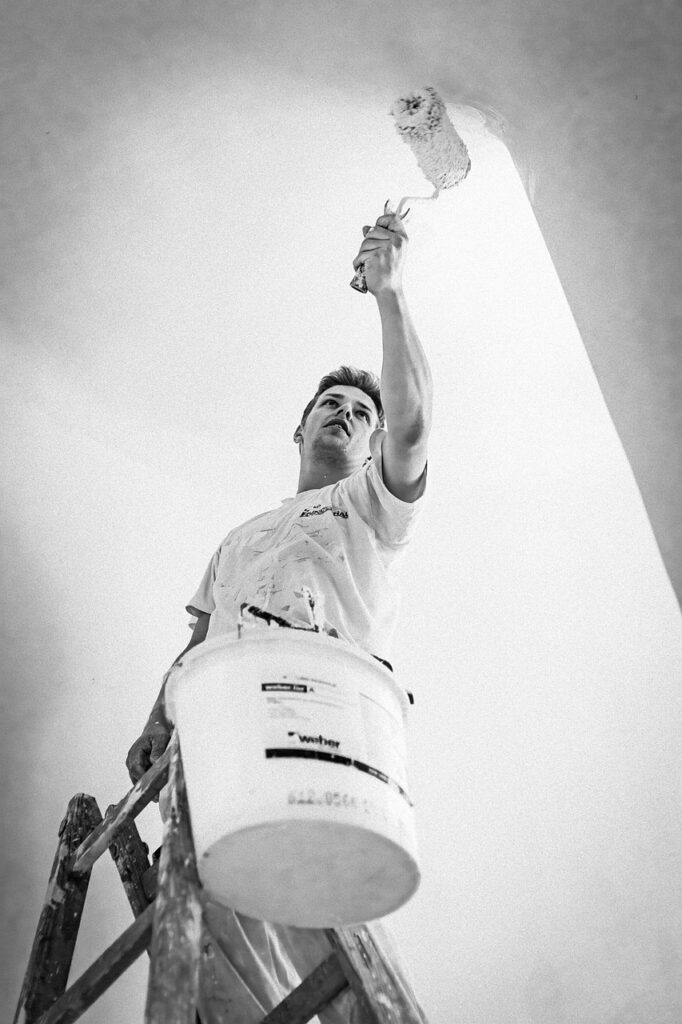

And so, the couple embarked on their renovation adventure. Armed with paint, tools, and a sense of humor, they dived headfirst into the chaos of their new project. With every step, something seemed to go comically wrong. The paint color turned out to be a vibrant shade of pink instead of the serene blue they’d envisioned. When they tried to replace the old carpet, they discovered an army of squirrels had turned it into their secret hideout.

One afternoon, while hammering away at a wall, the ceiling suddenly gave in, sending a shower of dust and debris down upon them. Emily and Henry stood amidst the chaos, laughing so hard that their tears mixed with the dust on their faces.

“What do you say, Em? Maybe we should hire a professional?” Henry joked, a sly grin on his face.

“No way! This is our adventure, Henry!” Emily declared, a twinkle in her eye.

Weeks turned into months, and their renovation project began to take shape. They learned how to fix the plumbing, repair the roof, and even install a chandelier that, despite its elegant appearance, blinked in protest as if doubting the couple’s design choices.

The Renovation Happy Ending

One sunny afternoon, Emily stood in the garden, hands on her hips, surveying their hard work. The house was transformed into a cozy, charming cottage. The garden bloomed with vibrant flowers, and a white picket fence framed the property. It was no longer a dump; it was their dream home.

Henry approached Emily, a smile on his face as he held a bouquet of fresh flowers. “Em, you’re amazing, you know that? I couldn’t have done this renovation without you.”

Tears welled up in Emily’s eyes, but she brushed them away with a laugh. “I wouldn’t have done it without you, Henry. We make a great team.”

With a peck on the cheek, Henry whispered, “And it’s all because we turned this place into our very own adventure.”

As they embraced, a gentle breeze ruffled the flowers in their garden, and the chandelier inside flickered but ultimately decided to give in to the cozy, welcoming atmosphere.

And so, the couple’s once-broken house transformed into a charming haven, and their laughter-filled journey became the stuff of legend in the town of Harmonyville. Together, they learned that a house was more than bricks and mortar; it was where love, laughter, and a dash of insanity could truly make a home.